"From Paper Statements to E-Statements: Embracing the Digital Revolution in Personal Finance" for Dummies

Online Banking versus Traditional Banking: Which is Right for You?

In today's electronic grow older, the way we handle our finances has transformed greatly. Gone are actually the days of hanging around in long queues at brick-and-mortar banking companies simply to deposit a examination or transmit funds. Along with the surge of on-line financial, taking care of our loan has come to be extra practical and available than ever before previously. Having said that, traditional financial still stores its ground for a lot of people who like a a lot more individual touch when it happens to their economic undertakings. In this post, we will discover the key distinctions between online financial and typical banking to aid you find out which possibility is ideal for you.

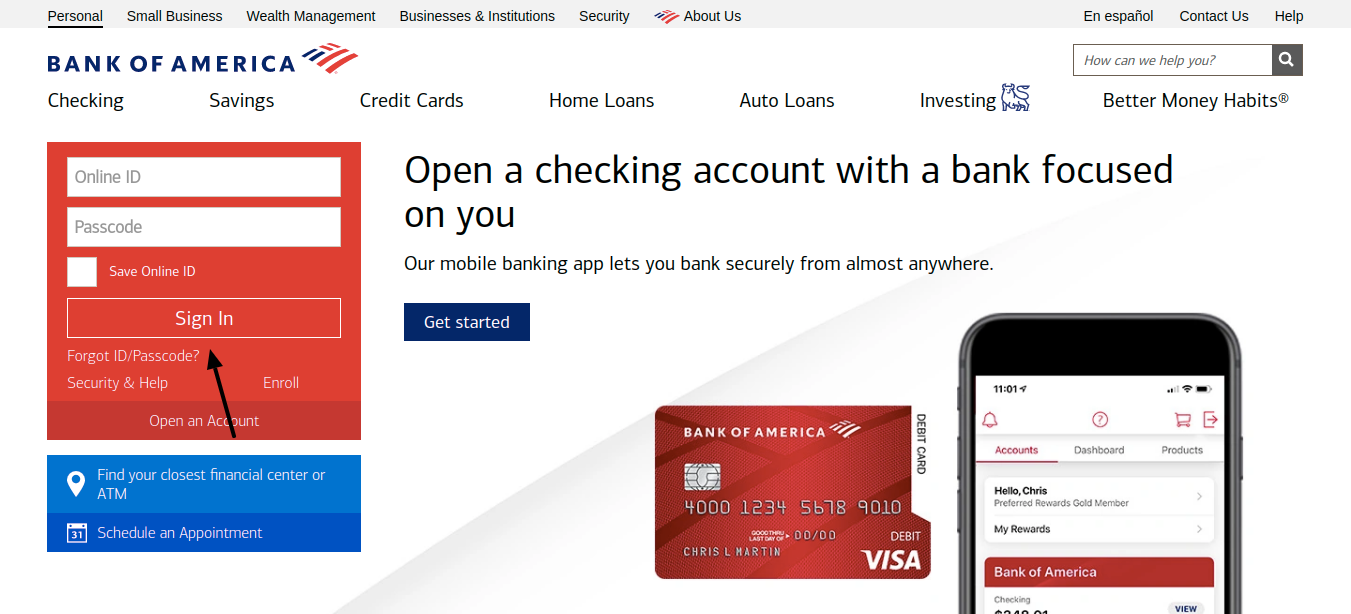

Comfort is one of the very most notable perks supplied by on the web financial. With simply a few clicks on, you may access your account coming from anywhere at any kind of opportunity. Whether you're at residence, at work, or even on trip, on the web banking allows you to examine your profile equilibrium, income bills, transmission funds between accounts, and even apply for lendings or credit report memory cards without having to visit a physical branch. This level of access helps make on-line financial suitable for those with occupied schedules who value ease and productivity.

On the other hand, conventional banking provides a more personal encounter that some individuals discover reassuring and dependable. Being capable to communicate face-to-face with financial institution bank employees and advisors can be calming when working with complex financial concerns or looking for advice on financial investments. Additionally, traditional banking companies frequently provide personalized companies such as notary services or support with applying for lendings that may not be readily on call by means of internet platforms.

Safety is one more essential aspect to consider when reviewing on the web financial and typical financial. On-line banking companies have applied state-of-the-art surveillance action such as file encryption innovation and multi-factor authentication to shield customers' delicate relevant information from unauthorized accessibility. Nonetheless, problems regarding hacking and identification theft still exist in the world of on-line purchases.

Typical banking companies also focus on safety and security by utilizing bodily security measures within their branches such as security cameras and secure safes for saving cash deposits. Some people may discover comfort in the substantial visibility of these safety step, as it offers a feeling of security for their loan.

Fees and fee may vary between on the web banking and typical banking solutions. On the web banks typically give reduced fees and higher interest prices on savings accounts due to their lesser overhead expense matched up to typical banks. This Website can be particularly valuable for those looking to optimize their financial savings or lessen their expenses.

Standard banking companies, on the various other palm, might have higher fees linked with solutions such as overdraft security or newspaper claims. However, they may also supply additional advantages like forgoed fees for making use of ATMs within their network or access to unique perks with support programs.

Ease of access is an crucial element that differentiates on the internet banking coming from standard banking. In remote control regions where bodily bank divisions are scarce, on the web financial offers a feasible option for people who would typically experience significant problem in accessing monetary solutions. Moreover, people along with mobility concerns or impairments may find internet banking more comprehensive and accommodating.

Nevertheless, it's worth taking note that not everyone has very easy gain access to to the internet or possesses the important digital education skills required for reliable online financial. In such cases, traditional banking companies stay crucial in delivering monetary companies to people who count on in-person assistance.

The decision between on the web financial and typical financial eventually happens down to individual desires and personal situations. If you value ease, ease of access, and cost-effectiveness, at that point internet financial might be the ideal selection for you. On the various other hand, if you prioritize personalized service, face-to-face communications along with bank personnel, and a sense of protection offered through physical branches, after that standard banking could suit your necessities better.

It's significant to keep in mind that lots of people opt for a mix of both internet and conventional banking strategies. This hybrid method enables them to benefit from the advantage of on the web deals while still possessing access to personalized support when required.

In conclusion, whether you choose on-line banking or adhere along with conventional methods relies on your individual preferences and demands. Each options deliver distinct advantages and negative aspects. Through reviewing your requirements, top priorities, and comfort level with modern technology, you can easily create an informed choice on which financial choice is ideal for you.